News Posts List

Financial Literacy: Rule #1 - Don’t Lose Money

12/10/2020

Financial Literacy: Rule #1 - Don’t Lose Money

by Captain Bob Houle, USCG (retired)

This being the January issue one would expect that this month’s topic would be on New Year Resolutions and things that we should do to be financially successful. Not this time. Why?

Various studies have shown that avoiding losses is much more of a motivator than the possibility of a gain. Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. The principle is prominent in the domain of financial literacy. Some studies have suggested that losses are twice as powerful, psychologically, as gains. The math backs that up: a 50% drop in your portfolio requires a 100% gain just to get back to even.

This brings us to our topic: don’t lose money. In every aspect of the financial literacy domain there are very real opportunities to experience pain from making poor choices.

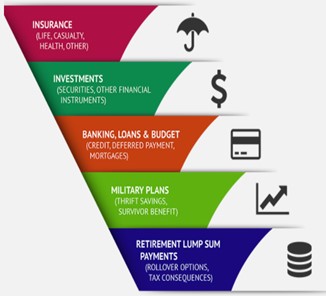

Financial literacy education is a very broad topic area with all kinds of proven success tips. To get an appreciation of how big the program area is we only need look at the subjects that are required to be covered in military financial literacy programs.

The programs specify significant triggering events in an individual’s service when financial instruction must be delivered, including at initial entry training, arrival at first duty station, each transfer of duty station, during leadership training, at time of investment in the Thrift Savings Plan (the military retirement plan), and upon promotion, pre-deployment, or post-deployment.

Training also coincides with each servicemember’s major life events, such as marriage, divorce, birth of the first child, and disabling sickness or condition.

In each of these areas there is the likelihood to suffer real pain from making bad decisions. The desire to avoid making bad decisions is much more of a motivator than the potential gain from making good decisions. New Year resolutions are worthless unless action is taken. Action taken to avoid pain is a very valuable topic for developing our New Year resolutions.

Let’s focus on one segment of the financial literacy domain by listing the fifteen biggest retirement planning mistakes people make.

- Falling for too-good-to-be-true offers

- Planning to work indefinitely

- Putting off saving for retirement

- Debt

- Emergency savings

- Claiming Social Security too early

- Downsizing your retirement contributions while you’re working

- Borrowing from your retirement funds

- Putting your kids first

- Avoiding the stock market

- Running out of money before running out of time

- Health care

- Long term care

- Neglecting Estate Planning

- Borrowing against your home

Each of these topics warrant further discussion in future Financial Literacy articles. Which ones would you most like to know more about? Click to take a short survey to let us know (https://sites.google.com/view/moaacc-finlit/moaacc-finlit?authuser=0).

Thank you again for your service to our country and to our fellow members and their families. It’s time for all of us to take action and help others become financially secure and independent. Never Stop Serving!

.jpg)